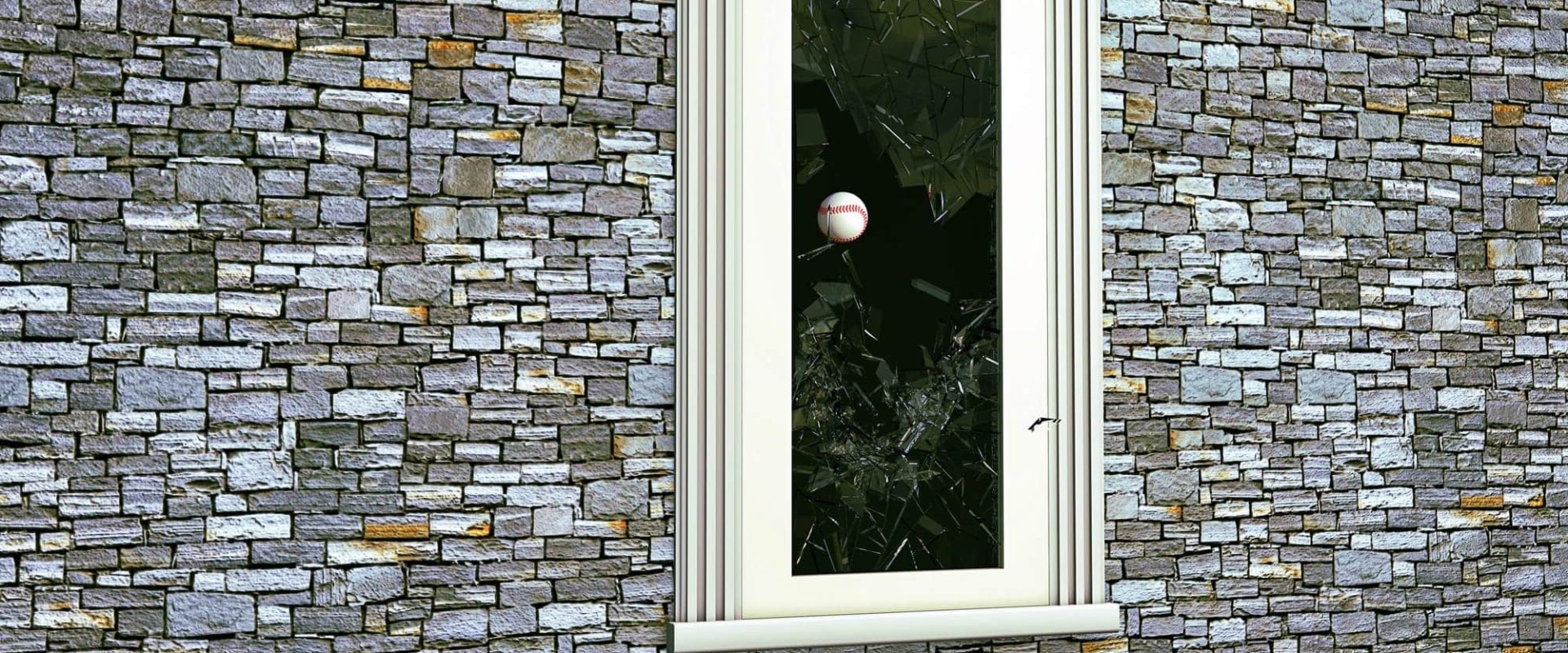

Homeowners insurance is a great way to protect your home and its contents from damage caused by covered hazards. However, it's important to understand that not all window damage is covered by homeowners insurance. In some cases, you may be able to get your insurance company to cover the cost of replacing windows, but it depends on the type of damage and the policy you have. When it comes to window repair and replacement, homeowners insurance typically covers damages caused by covered hazards, such as a tree branch falling during a storm and cracking the window.

However, it does not cover window maintenance problems or wear and tear. If your window needs repair or replacement because it's drafty, for example, homeowners insurance won't cover the cost. Broken window seals may also not be covered by homeowners insurance. If there is a strong wind outside and a branch passes through your window, you may be tempted to contact your insurance company and request that an appraiser visit your home.

Typically, repair and replacement costs billed by a window and roof contractor are covered by your insurance provider. However, depending on how your windows were damaged, your insurance policy may or may not cover the damage. A homeowners insurance deductible denotes the amount of out-of-pocket money you'll need to provide before insurance companies pay a claim. If you have a high-deductible policy to lower your premiums and the cost of replacing the window is relatively low, then the replacement amount probably won't exceed your deductible.

The policy you have will determine what damages are insured and help you estimate potential out-of-pocket window repair costs. If you have window structures on your property that are not directly connected to your home, such as a separate garage or shed, they are protected by the other structures part of your homeowners insurance policy. Work with an experienced window repair company to receive valuable insurance claim assistance when damage occurs. The maximum home coverage in your policy must match the value of your home, so you'll always have enough coverage to replace all the windows in your house if they all broke due to the same hazard. With extensive damage to windows, feel free to contact both your insurance company and the trusted window repair company to fix the problem immediately before it goes out of control and ultimately costs you more money. When you file a claim for your homeowners insurance, your insurance provider sees it as a negative mark against your coverage. One of the most important functions of an insurance lawyer is to advise their clients on insurance companies inclined to keep their promises. In conclusion, homeowners insurance may cover the cost of replacing windows if they are damaged by a covered hazard.

No, homeowners insurance will never cover old windows unless they have been damaged or broken by a covered hazard. As with broken windows, homeowners insurance will cover window leaks caused by a covered hazard.